Which International Money Transfer Service is More Convenient, Wise (Formerly TransferWise) or Curfex? Thorough Comparison of International Money Transfer Services

An international money transfer service is a convenient means of sending money to family and friends living abroad.

While bank transfers have long been the mainstream means for money transfers, they can be completed easily nowadays using a smartphone. Also, the popularity of international money transfer services is rapidly growing.

In this article, we will introduce two international money transfer services: Wise, a well-known service, and Curfex, which shows a rapid increase in its user number.

We will provide an overview of Wise and Curfex's services and features, as well as a thorough comparison. After reading this article, you will know which service has lower fees, and what users say about both services!

Service Overview: Wise (Formerly TransferWise)

First, we will look at an overview of Wise's international money transfer service.

Wise is an international money transfer service that started operation in Japan in 2016. Formerly known as "TransferWise," it changed its name to "Wise" in 2021 and now has over 10 million users.

Wise is characterized by the number of currencies and countries it supports. Transactions are available for 52 currencies, including major ones with a large number of users, such as the US dollar and the Korean won.

In addition, remittances can be made to 77 countries, making it convenient for users who visit multiple countries on business trips, volunteer activities, etc.

Wise also holds a qualification as a money transfer agent as stipulated by the Japanese government for its international money transfer business. Since it is approved by the government, there is no need to worry about fraudulent activities, assuring users' peace of mind.

Service Overview: Curfex

Next, we will look at the basic information about Curfex's international money transfer service.

Curfex is an international money transfer service established in 2015 and has over 6 billion yen in monthly transactions worldwide. The company was originally established with its headquarters in Hong Kong, but later established a Japanese subsidiary, and now has a growing number of Japanese users.

One of the main features of Curfex is its significantly low remittance fees.

Generally, financial institutions and money transfer services set their own exchange rates by adding fees to the market exchange rate. Curfex, on the other hand, uses the mid-market rate, which is the actual exchange rate in the market, so there are no additional fees.

Curfex also holds a license as a money transfer agent as stipulated by the government, and has approval from the Financial Services Agency. Even in the event of a default on the end of Curfex, users can rest assured that their money will be transferred as the FSA holds a deposit. The guaranteed safety and reliability are also key features of Curfex.

Wise and Curfex: Comparison by Feature

Now that we have given an overview for both services, we will now look into features that would help you choose one.

The list below shows the key factors when comparing international money transfer services. Please use it as a reference to compare the service details of Wise and Curfex.

Fees

As for fees, both Wise and Curfex are characterized by low fees among services that provide international money transfers.

The following are the types of fees typically charged for international money transfers.

If you use a bank for your international money transfer, these four fees will be charged with each transaction. On the other hand, in many cases, international money transfer services only charge a remittance fee and a currency exchange fee, and the receiving fee and relay bank fees, which are unique to bank remittances, will not be incurred.

In addition, Wise and Curfex do not set any additional fees on top of the exchange rate, so only the actual transfer fee is charged, making the process very economical.

With Wise, a fixed fee is charged depending on the country to which the money is sent. Curfex does not charge a fee for the first transfer, and the fee after the second time is low at 1% of the amount transferred.

If you want to keep the fees low, Curfex would be an easy option. On the other hand, if you plan to make repeated transfers to countries with low fixed fees, you would not have inconvenience with Wise.

Processing Time

The second factor to be considered is the processing time.

Processing time refers to the number of days it takes to complete the international money transfer after the procedure is completed. If you need to send money urgently, you probably want to choose a service with as short as possible processing time.

Comparing bank transfers and international money transfer services, by far, international money transfer services require less time. While bank transfers generally take 5 to 7 days to send money, most international money transfer services take around 3 days.

So how long does it take to complete a transfer with Wise and Curfex?

Both Wise and Curfex are known to be very speedy, either on the same day or within one to two business days.

Although the processing time varies slightly depending on the country and currency used, in most cases, both services are completed within two business days.

There is no significant difference in the processing time between Wise and Curfex, and both are excellent international money transfer services that provide a speedy response.

Exchange Rate

Next, we will look at the exchange rate.

In most cases, when proceeding with international remittance procedures, many financial institutions and services set their own exchange rates by adding a fee on top of the market exchange rate. Many users assume that the amount is the same for all services, but the rate varies from service to service. In some cases causing a significant difference in the total fee, which is why they are known as "hidden fees.”

Wise and Curfex are free of these "hidden fees", as they both adopt the market exchange rate as it is and do not add their own fees.

If you wish to avoid "hidden fees" included in the service’s original exchange rate, both Wise and Curfex would be ideal options.

Campaigns/Discounts

The fourth criterion is the availability of campaigns and discounts.

Some international money transfer services offer limited time offers or first-time-only offers.

If you need to transfer money anyway, why not take advantage of this benefit with your transaction?

As of 2022, Wise does not offer any special offers, but Curfex offers a first-time-only offer: a fee waiver for the first-time international money transfer.

Curfex usually charges a fee of 1% of the amount transferred, so for example, if you send 100,000 yen, the fee of 1,000 yen will be waived.

If you plan to make several separate transfers, we recommend that you use Curfex to send a large amount of money the first time, so that you can complete the transfer process at a reasonable cost.

Security

Finally, the last criterion is security.

International money transfers deal with money. Needless to say, security is a very important factor to be considered when choosing a service.

To get straight to the conclusion, both Wise and Curfex are very secure services with high credibility, as they both hold the qualification as a funds transfer service provider stipulated by the government.

In addition, Curfex is licensed by the Financial Services Agency (FSA) and deposits funds with them. It means that even in the event of a default on the end of Curfex, users do not have to worry about not receiving the money, making it a highly secure service.

Wise and Curfex Service Comparison

The table below compares Wise and Curfex’s services based on the features discussed above.

Please refer to this to help you determine which service better suits your criteria.

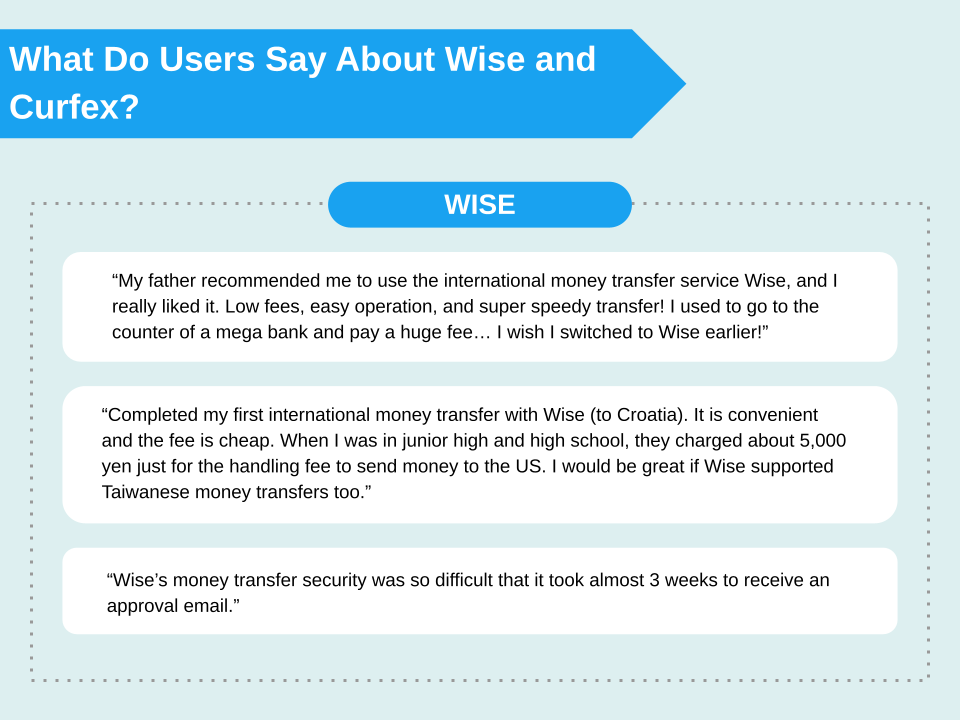

What Do Users Say About Wise and Curfex?

What are users’ opinions about Wise and Curfex?

Here are some reviews and ratings from users of each service.

Reviews from Wise Users

The following are some of the reviews found from Wise users.

“My father recommended me to use the international money transfer service Wise, and I really liked it. Low fees, easy operation, and super speedy transfer! I used to go to the counter of a mega bank and pay a huge fee… I wish I switched to Wise earlier!”

“Completed my first international money transfer with Wise (to Croatia). It is convenient and the fee is cheap. When I was in junior high and high school, they charged about 5,000 yen just for the handling fee to send money to the US. I would be great if Wise supported Taiwanese money transfers too.”

“Wise’s money transfer security was so difficult that it took almost 3 weeks to receive an approval email.”

Many have expressed surprise at the simple operation and smooth procedure. Some have commented that they were able to save the large fees charged by banks since they started using Wise.

Since it is a well-known service, Wise receives a variety of comments, making it an easy service to refer to the users' opinions.

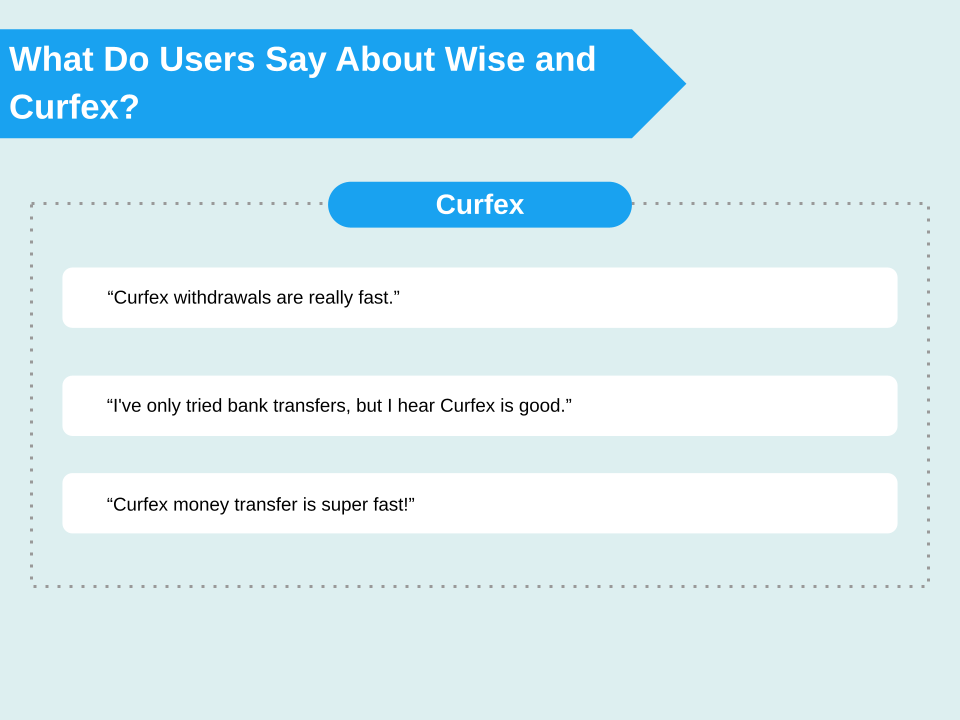

Reviews from Curfex Users

The following reviews were from Curfex’s users.

“Curfex withdrawals are really fast.”

“I've only tried bank transfers, but I hear Curfex is good.”

“Curfex money transfer is super fast!”

Many Curfex reviews were highly praised for the speed and convenience of the money transfer process.

The quick transfer also seems to be very popular with those who use foreign exchange services often.

Also, Curfex did not have as many user reviews as Wise, since it is relatively a new service that is just starting to attract attention. Some users commented that they have heard of the good reputation but had not yet used the service. This is a good indication that Curfex is a service that is likely to see a rapid increase in the near future.

Author’s Recommended International Money Transfer Services

Both Wise and Curfex are international money transfer services with attractive features.

The best service to use will depend on what your priority is, so here is our view on recommended international money transfer services depending on your needs.

For Those Who Prioritize Name Recognition

If name recognition is important to you, and you would like to refer to many user reviews, Wise is a good choice.

Wise is one of the best-known international money transfer services in Japan. Due to this, a large number of user reviews are available, so we recommend Wise to those who would like to check user reviews as a reference.

Meanwhile, Curfex is a service with a growing number of users in Japan in recent years. It is an excellent service that may well surpass Wise in the future, but at this point, it can be said that Wise is better known.

For Those Who Prioritize a Low Fee

Although both services have low fees, we recommend Curfex if you want to keep your fees as little as possible.

As mentioned previously, Curfex is currently offering a campaign with a first-time fee waiver. If you are only planning to send money once, you can definitely take advantage of this campaign. Even if you are going to send money multiple times, you will benefit greatly if you plan to send a large amount with the first transfer.

As for the fees for the second and subsequent transfers, Wise charges a fixed fee for each country, so the fee will vary depending on which country you send money to.

Curfex has a flat 1% fee for the second and subsequent transactions, so you can rest assured without the worry of fluctuating fees.

Recommended Services Depending on the Destination

Curfex has a fixed fee of 1%, but Wise's fee varies depending on the country to which you send money.

How big of a difference would there be between Wise and Curfex in the transferring amount, processing time, and other factors depending on the destination? We will present some examples below.

Money Transfers to Korea

If the remittance destination is Korea, how would the processing time and fees be for Wise and Curfex?

In addition to the two services, the article below compares some other commonly used international money transfer methods for sending money to Korea.

https://curfex.ghost.io/international-money-transfer-service-comparison-for-korea-en/

Money Transfers to China

The article below compares Curfex and Wise, as well as some other commonly used international money transfer methods for sending money to China.

https://curfex.ghost.io/transferring-money-family-friends-china-en/

Money Transfers to Thailand

Visit the article below to check the simulation of the processing time and fees with Wise and Curfex, as well as some other commonly used international money transfer methods for sending money to Thailand.

Money Transfers to the U.S.

Visit the article below to check the simulation of the processing time and fees with Wise and Curfex, as well as some other commonly used international money transfer methods for sending money to the US.

https://curfex.ghost.io/money-transfers-japan-us-basic-knowledge-en/

https://curfex.ghost.io/money-transfers-japan-us-basic-knowledge-en/Money Transfers to Europe and Germany

Visit the article below to check the simulation of the processing time and fees with Wise and Curfex, as well as some other commonly used international money transfer methods for sending money to Europe, including Germany.

Achieve a Smooth Money Transfer Using International Money Transfer Services!

When choosing an international money transfer service, be sure to check in advance the fees, processing time, the availability of benefits, and the security of the service, and choose a company that provides the service meeting your needs.

Both Wise and Curfex are services that are currently attracting a lot of attention. In particular, Curfex's first-time fee waiver campaign allows users a money transfer at an extremely low price, so it is a service we can recommend with confidence. Curfex is also dedicated to the Japanese market, so it offers excellent support for Japanese people, including a chatbot that allows them to easily ask questions when they need help.

If you plan to use international money transfers soon, we highly recommend signing up with Curfex now and be ready for your first-time transfer at no charge!

References:

https://wise.com/jp/

https://wise.com/jp/terms-of-use

https://wise.com/jp/blog/revolut-wise-comparison

https://www.watch.impress.co.jp/docs/news/1307840.html

https://www.curfex.com/

https://emotional-link.co.jp/kaigaifx/curfex/

https://fxex.jp/curfex/

https://twitter.com/aikanium/status/1605528270543286272

https://twitter.com/naruminzzz/status/1605047663699034112

https://twitter.com/uyu5k/status/1607482425868947457

https://twitter.com/Dr_Golder/status/1166603451603783681

https://twitter.com/gold_coconat/status/1348551661413810177

https://twitter.com/LZBkadjQ1ioLcCw/status/1428209860085121024

Member discussion