Is Japan Post Bank the Best Service for International Money Transfers? Introducing More Economical Options

Are you planning on sending finances to support your family who is living abroad?

Do you need to pay a deposit to a school in another country?

Even if you live in Japan, you may need to send money internationally if you have family members staying in other countries for business or education.

Many people may not be familiar with international money transfers, and do not know which financial institutions to use or what services are available.

One of the most popular options for international money transfers is Japan Post Bank. As it is operated by Japan Post, many find it familiar and trustworthy.

Of course, the Japan Post Bank's international money transfer service is reliable and used by many people. However, there are more convenient and affordable options for international money transfers.

In this article, we will introduce the costs incurred in international money transfers and some other recommended services than Japan Post Bank.

For those with plans to transfer money internationally in the future, it is worth learning more in advance to ensure a smooth and cost-effective remittance.

Four Types of "Costs" Incurred during International Money Transfers

There are four types of costs associated with international money transfers, including both monetary and time costs. These costs act as important indicators when choosing a service.

Remittance Fee

The first cost is remittance fee.

A remittance fee is charged when sending money internationally.

The remittance fee with Japan Post Bank is set higher than those charged by other financial institutions.

For online transfers using Yuucho Direct, a fee of 3,000 yen is charged per transaction. Over the counter services charge an even higher fee of 7,500 yen, which is a point to take into consideration.

Exchange Rate

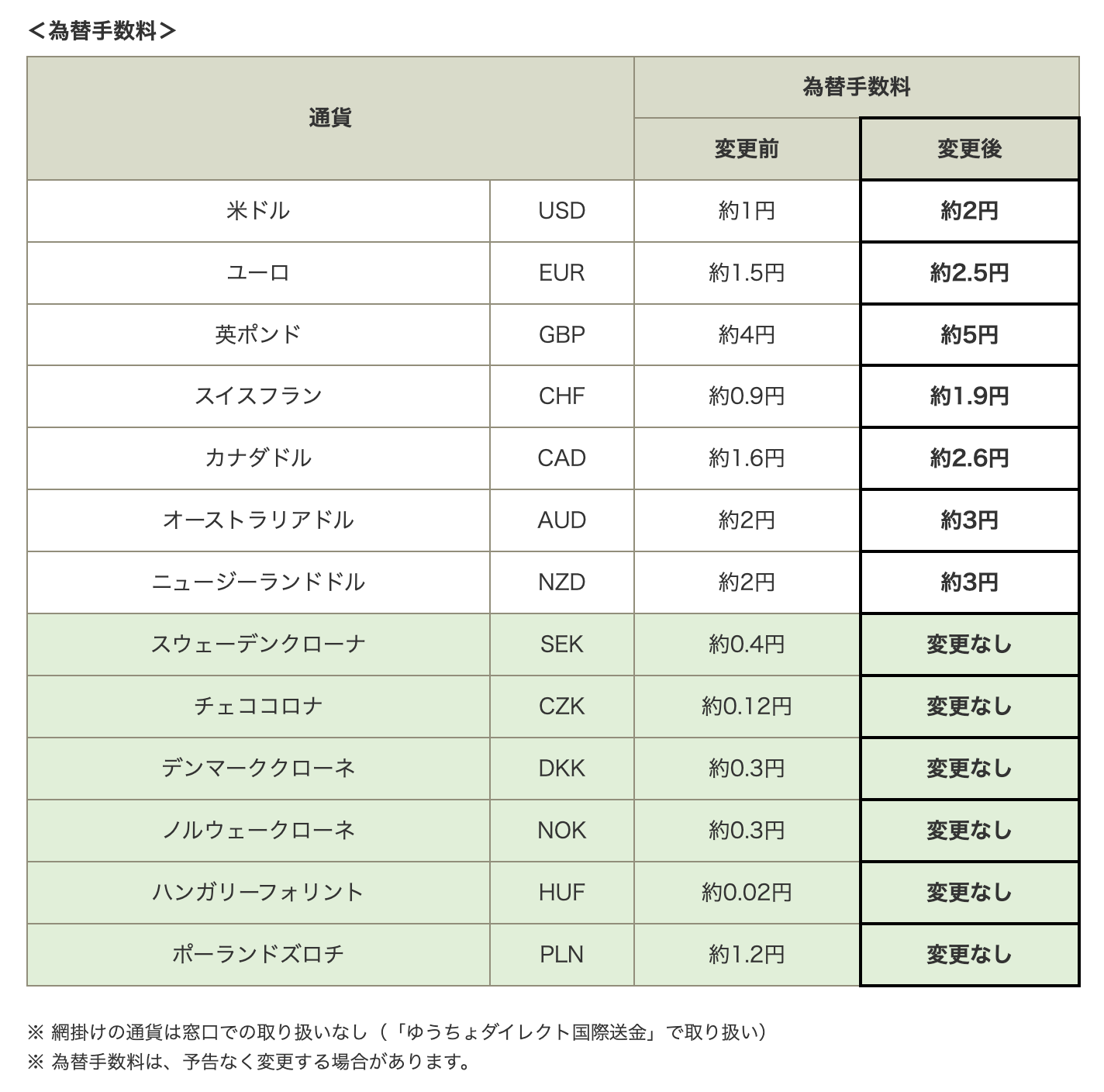

The second cost is exchange rate.

In most cases, each financial institution uses its own exchange rate in which a commission is added to the original rate. The exchange fee is charged when converting yen into a foreign currency based on this original rate.

The fee is charged per dollar, and this totals into the exchange fee. Therefore, it is preferable that the commission fee is not added to the amount of the currency exchange.

At Japan Post Bank, the fee varies depending on the currency, but in most cases, the fee is usually between 2 to 5 yen per dollar.

Reference

https://www.jp-bank.japanpost.jp/news/2019/news_id001426.html

Relay and Receiving Fees

The third cost is relay and receiving fees.

A relay fee is charged by financial institutions that relay the money when the bank sends money to a bank abroad. The amount incurred varies depending on the route through which the remittance is made, but the more financial institutions involved, the higher the relay fee.

Another fee is charged upon receiving the transferred money, known as a receiving fee. In many cases, the remitter bears the receiving fee, which is deducted from the transferred amount. When the received amount is less than expected, it suggests that multiple relay banks may have been involved in a transaction, or a receiving fee is deducted.

Remittance Time

Cost does not only mean money but also time. So, the fourth cost is the number of days it takes to transfer the money.

Remittance time usually refers to the days it takes from the time the procedure is started to the time it is completed. However, it is notable that completing the procedure does not always mean the completion of the money transfer.

Once the procedure is completed, the bank then transfers the designated amount of money, which finally reaches the receiving bank after passing through several relay banks.

We recommend using a service that is as speedy as possible to make sure the remittance is completed in time, especially when in a hurry.

International Money Transfer via Yuucho Direct

In addition to procedures at the bank counter, Japan Post also offers a service called Yuucho Direct, which is available online.

With this service, banking procedures can be done without having to visit the counter, which saves time and effort.

In this section, we will look into the costs incurred with money transfers via Yuucho Direct, as well as the destination countries they support and the transfer amount limit.

Fees

First, let us look at the fees charged for international money transfers.

The types of fees charged for international money transfers when using Yuucho Direct are as follows.

- Remittance fee

- Exchange fee

- Relay fees and receiving fees

When using Yuucho Direct, a remittance fee of 3,500 yen is charged per transfer.

Exchange fees will be discussed in-depth in the following section.

Relay bank fees and receiving bank fees also vary depending on the route of remittance and the number of banks in the relay, and users can check the total fee when the procedure is completed.

It is important to note that these fees are not fixed in advance, so there is a risk that the fees will end up higher than expected.

Exchange Rate

The exchange fee charged by Yuucho Direct varies depending on the amount of money transferred. The table below gives an indication of how much yen is charged per dollar.

Example of Exchange Fees to be Incurred

Length of Procedure

Money transfers via Yuucho Direct usually take a shorter time than transactions over the counter. Nevertheless, it still takes about 2 to 4 business days, so ideally, the procedure should be done about a week before the desired date of transfer completion.

Many people fail to complete the remittance by the scheduled date because the procedure takes longer than expected. Unlike domestic money transfers, international money transfers involve the exchange of money on the country-to-country level, so remember to allow a certain time for procedures to be completed.

Destination Countries

The destination countries supported by Yuucho Direct are as follows.

Asia & Middle East

Azerbaijan, Afghanistan, United Arab Emirates, Armenia, Yemen, Israel, India, Indonesia, Uzbekistan, Oman, Kazakhstan, Qatar, Korea, Cambodia, Cyprus, Kyrgyz, Kuwait, Georgia, Saudi Arabia, Singapore, Sri Lanka Thailand, Taiwan, Tajikistan, China, Turkmenistan, Turkey, Nepal, Bahrain, Pakistan, Bangladesh, Timor-Leste, Philippines, Bhutan, Brunei, Vietnam, Hong Kong, Macau, Malaysia, Maldives, Mongolia, Jordan, Laos, Lebanon

Oceania

Australia, Kiribati, Samoa, Solomon Islands, Tuvalu, Tonga, New Caledonia, New Zealand, Papua New Guinea, Palau, Fiji, Polynesia, Marshall Islands, Micronesia, Wallis and Futuna Islands

Europe

Iceland, Ireland, Albania, Andorra, United Kingdom, Italy, Ukraine, Estonia, Austria, Netherlands, Greece, Greenland, Croatia, San Marino, Switzerland, Sweden, Spain, Slovakia, Slovenia, Serbia, Czech Republic, Denmark, Germany Norway, Vatican, Hungary, Finland, Faroe Islands, France, Bulgaria, Belgium, Poland, Portugal, Malta, Monaco, Moldova, Latvia, Lithuania, Liechtenstein, Luxembourg, Romania, Russia

America

United States, Argentina, Antigua and Barbuda, Uruguay, Ecuador, El Salvador, Guyana, Canada, Guatemala, Guadeloupe, Grenada, Costa Rica, Colombia, Saint BarthÉlemy, Saint Pierre, Salmantan, Jamaica, Suriname, Saint Kitts and Nevis St. Vincent and the Grenadines, St. Lucia, Chirie, Dominican Republic, Dominican States, Trinidad and Tobago, Nicaragua, Haiti, Panama, Bahamas, Paraguay, Barbados, Brazil, Guiana, Venezuela, Belize, Peru, Bolivia, Honduras, Martinique Island, Mexico

Africa

Algeria, Angola, Uganda, Egypt, Swaziland, Ethiopia, Eritrea, Ghana, Cape Verde, Gabon, Cameroon, Gambia, Guinea, Guinea-Bissau, Kenya, Cote d'Ivoire, Comoros, Republic of Congo, Sao Tome and Principe, Zambia, Djibouti, Seychelles, Guinea Senegal, Somalia, Tanzania, Chad, Central Africa, Tunisia, Togo, Nigeria, Namibia, Niger, Burkina Faso, Burundi, Benin, Botswana, Mayotte, Madagascar, Malawi, Mali, South Africa, Mauritius, Mauritania, Mozambique, Morocco Libya, Rwanda, Lesotho, Reunion

The fact that so many countries accept money transfers can be said to indicate that many international money transfers are made through Japan Post Bank due to its high social credibility.

Remittance Limit

Each financial institution or service has a set limit on the amount of money that can be transferred.

The limits for international money transfers via Yuucho Direct are as follows.

- 1 million yen per procedure

- No more than 2 million yen per day

- No more than 5 million yen per month

Larger amounts woud require planning ahead to break the remittance down into smaller transfers.

Points to Keep in Mind When Making International Money Transfers Through Japan Post

Let us discuss the points to keep in mind when sending money internationally using Yuucho Direct.

The following are some features of international money transfers at Japan Post Bank that are worth noting.

Higher Fees Compared to Other Services

The first point is the high fee.

International money transfers incur transfer fees, relay bank fees, and exchange fees, which are higher for Japan Post than other services.

The remittance fee for over-the-counter procedures is high at 7,500 yen, and there are also relay bank fees for bank transfers.

Although many people are accustomed to bank procedures and may feel safe, it is not the most recommended option if you want to keep fees low.

Longer Time to Complete the Procedure

The next point is how long it takes to complete the procedure.

It takes at least 4 business days for over-the-counter procedures at the Japan Post Bank, and at least 2 business days through Yuucho Direct.

Those who need to send money urgently will find it difficult to proceed with the money transfer procedure on schedule with Japan Post.

To ensure that the money transfer goes as smoothly as possible, we recommend allowing enough time to complete the procedure.

Counter Procedures Takes More Time and Effort

Finally, the Yucho remittance procedure over the counter takes more time and effort.

While more and more services offer online transactions nowadays, over-the-counter procedures cost more than double that of Yuucho Direct and take about one week to be completed.

Certainly, procedures at the counter offer a sense of security as users can proceed with the procedures with the staff. However, the cost incurred is greater because of that, and users will have to travel all the way to the bank.

If you want to use Japan Post Bank in spite of itsdrawbacks, consider using Yucho Direct rather than in-person procedures to save fees.

Use Curfex’s International Money Transfer to Save Fees!

In this article, we have discussed the advantages and disadvantages of using Japan Post Bank for international money transfers. However, there are also other services that offer smoother transactions at a more economical price. In this section, we will take a look at Curfex, an international money transfer service we truly recommend.

Let us look into the advantages of using Curfex and compare its service with Japan Post Bank.

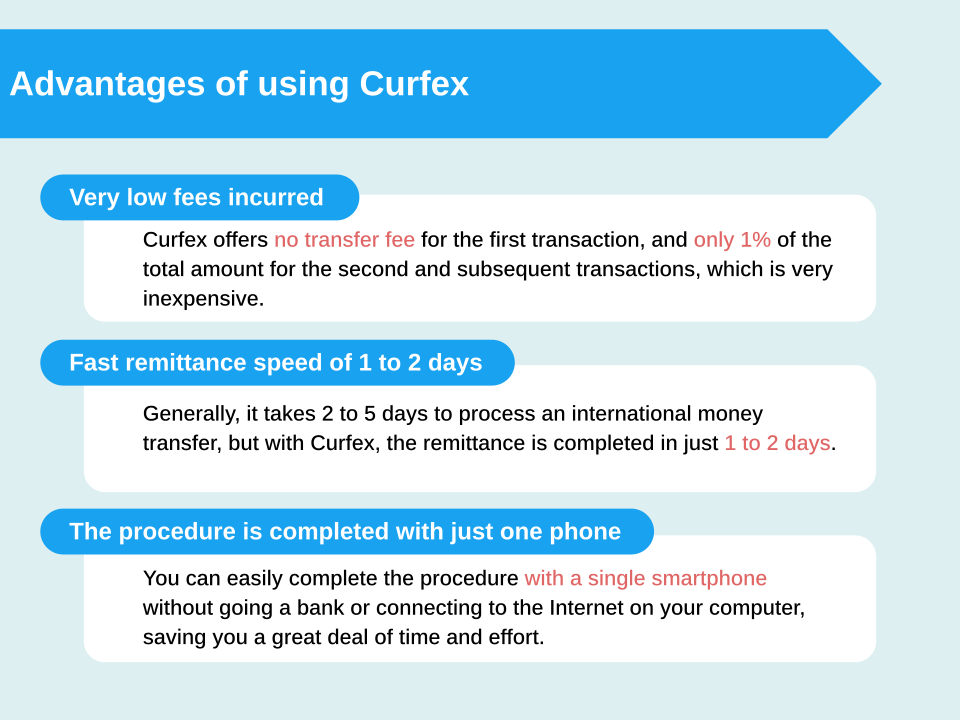

Advantages of Using Curfex

The following are some specific benefits of using Curfex.

- Low fees

- Speedy remittance (1 to 2 days)

- Procedures completed on the phone

The most notable characteristic of Curfex is its low fees.

Curfex offers no transfer fee for the first transaction, and even after the second time, it is set very low at 1% of the total amount.

Furthermore, it uses the mid-market rate with no fees added. Japan Post Bank charges an exchange fee of approximately 2-5 yen per dollar, while Curfex charges 0 yen which means no exchange fees are charged. Since this is not a bank procedure, no intermediary banks are involved in the procedure, making it almost a fee-free service.

Next is the speed of money transfer.

Curfex’s remittance is completed in 1 to 2 business days, while most services take 2 to 5 days. Curfex shows an unsurpassed advantage when it comes to urgent money transfers.

In addition, Curfex’s procedures can be completed anytime with a smartphone.

There is no need to travel all the way to the bank or financial institution or connect to the internet on a computer. Instead, it can be completed simply with a smartphone, saving a great deal of time and effort.

The simplicity, speed, and low cost are certainly unique features of Curfex.

Comparison: International Money Transfers at Curfex and Japan Post Bank

Finally, here is a comparison of the international money transfers by Curfex and Japan Post Bank.

Check the table below to review and compare the features of each service.

Curfex has an amazingly low remittance fee and takes only one to two days to complete the remittance, which allows speedy transfers.

Comparing these features, we can confirm that international money transfers through Curfex are both convenient and affordable.

Overall, Curfex has More Benefits than Japan Post Bank!

In this article, we looked at international money transfer transactions at Japan Post Bank.

A long-established financial institution with high social credibility, Japan Post Bank allows users to send money internationally with peace of mind.

On the other hand, it is also true that it has some inconveniences in terms of fees and the remittance speed.

Curfex's international money transfer service is the solution to such complaints.

Those planning to send money in the future, do take this opportunity to sign up with Curfex!

Click here to sign up

References:

https://www.jp-bank.japanpost.jp/news/2019/news_id001426.html

https://www.jp-bank.japanpost.jp/news/2019/news_id001426.htmlhttps://faq.jp-bank.japanpost.jp/faq_detail.html?id=2612&category=47&page=1

https://www.jp-bank.japanpost.jp/kojin/sokin/kokusou/direct/kj_sk_ks_dr_index.html

Member discussion