Recommended International Money Transfers Services for Studying Abroad

Are you planning on studying abroad sometime soon?

Are you worried that you might have missed something in your preparations?

If you have plans of studying abroad, you are probably excited about living in a new country, but you may also feel worried about preparations.

Especially if it is your first time traveling abroad, you may be too busy with passport preparations, packing, etc, and have no time for being excited.

One thing that many people tend to put off is the preparation for international money transfers.

Even if they have plans to receive money from family and friends living in Japan, many people put off the account setup because they can complete the process easily after moving to the country.

However, international transfers require complex procedures, such as identification, which must be completed in advance. If you fail to complete the account setup while in Japan, you will not be able to send money when you wish to.

In this article, we will introduce international money transfer services that are recommended to use while studying abroad. Make sure to create an account before leaving Japan so that you are prepared to send and receive money anytime.

When International Money Transfers are Needed While Studying Abroad

What are some situations where you will need money transfers while studying abroad?

In this section, we will introduce some examples based on people’s experiences.

When Receiving Living Expenses from Family

If you wish to receive living expenses from your family on a regular basis, you will likely use international money transfers.

For a long-term stay over several months, it is more common to receive a fixed amount of monthly living expenses from family members rather than receiving a lump sum in advance.

However, it is a surprisingly common mistake to forget to complete the setup beforehand and realize that you are not prepared to receive money a month into studying abroad. You would be in a very difficult situation where you will not be able to receive money until an account is set up.

If you plan to have living expenses sent to your study abroad destination, be sure to open an international money transfer account beforehand.

When Purchasing Additional Study Materials

The second case is when you need to purchase additional study materials at your overseas study destination.

In addition to the previously planned expenses, you may need to purchase additional study materials at the school in your study abroad destination.

Such unexpected expenses can cause you to run out of money and end up borrowing some from a local friend. Having an international money transfer account that allows you to exchange money between you and your family helps you avoid such inconveniences as well.

When You Lost Money Due to Unexpected Troubles

The last possible situation is when you encounter unexpected money-related problems, such as losing your wallet.

When living abroad, it is important to be prepared for unexpected problems, such as losing your wallet or having your belongings stolen. If you are a tourist and are not familiar with the local language, you may also be seen as an easy target for a scam.

Some students who studied abroad have experienced such problems as being pickpocketed on a train and having to live in poverty until they managed to open an international money transfer account.

Even if you believe you have enough money to live, there will always be unexpected problems when living abroad. It is essential to plan and be prepared financially for such situations.

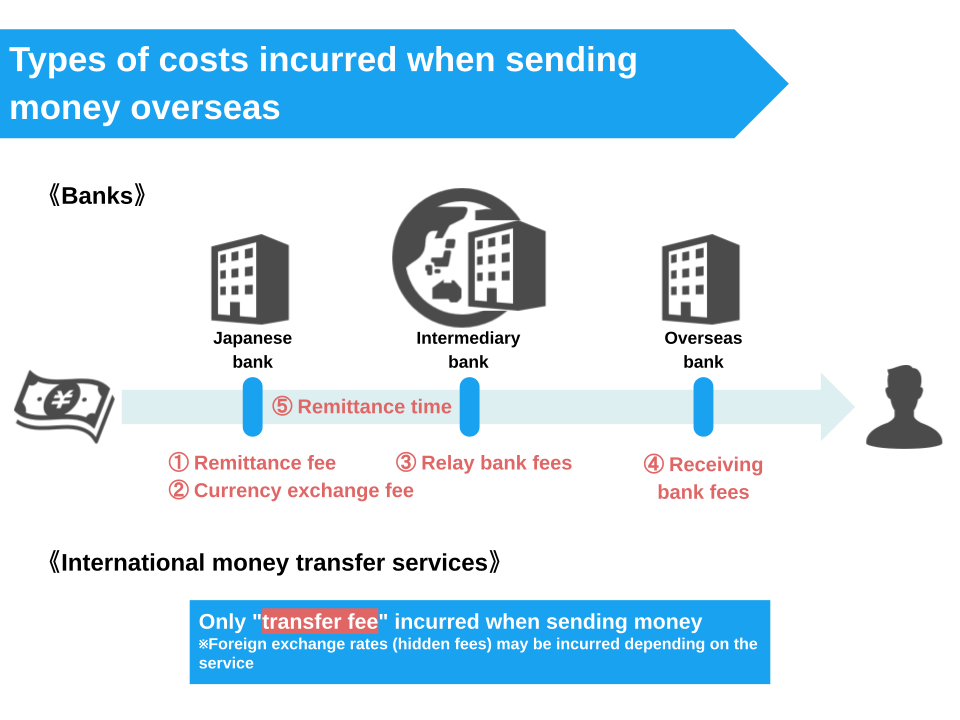

Types of Costs Incurred When Sending Money Overseas

So, what types of costs are incurred when using international money transfers? In addition to monetary costs, we will also discuss time costs in this section.

Remittance Fee

Remittance fee refers to the fees incurred by the bank or financial institution that handles your international money transfer. The amount defers depending on the institution, so it is a cost that users can minimize as much as possible.

Currency Exchange Fee

A currency exchange fee is charged when converting the currency of the original country to the currency of the destination country for international money transfers.

International money transfers are usually based on exchange rates, but many financial institutions set their own exchange rates by adding fees to the market exchange rate.

There are also services that use the market rate without additional fees. If you want to keep costs down, we recommend choosing one of them.

Relay Bank Fees

A relay fee is incurred when you choose to send money overseas through a bank.

When a bank sends money to another bank abroad, the money is transferred through several banks. These banks are called "relay banks," and "relay bank fees" refers to the fees charged by each of them.

International money transfer services do not charge these fees, so you can reduce the cost if you choose to send money using one of them.

Receiving bank fees

Similarly, receiving bank fees are also incurred limitedly for international money transfers handled by banks.

This refers to the fee charged by the receiving bank when the money passes through the sending bank and the relay bank to the receiving bank. Like relay bank fees, this fee is not charged with international money transfer services, so users can reduce this cost by choosing one of them.

Remittance Time

In addition to the monetary costs listed above, there are also time costs, such as the remittance time.

Remittance time is the duration it takes from the time the procedure is completed to the time the remittance is sent. Smoother and quicker procedures are more desirable because services that require fewer days to complete the transfer will reduce time costs.

Generally, it is said that it takes 5 to 7 business days to transfer money from a bank, while international money transfer services can complete the transaction in about 3 business days.

5 Popular International Money Transfer Services for Studying Abroad

In this section, we will introduce five services that are popularly used for international money transfers by students studying abroad. We hope it will help you sort out the characteristics and advantages of each service.

Wise

Wise is an international money transfer service that began operations in Japan in 2016 and now supports transactions to 77 countries. Since it handles transactions to a variety of countries in different currencies, it is unlikely to experience problems even if you are planning to study in a place that is relatively uncommon.

Another reason for Wise’s popularity is its smartphone app, which allows users to send money without opening their computers or visiting the bank.

The service charges a fixed fee depending on the destination country, but the cost of relay bank fees and receiving bank fees can be reduced. The exchange rate is also based on the market rate, suggesting that they offer transparent information with no “hidden fees.”

The remittance is also speedy, usually completed within the same day to two business days.

Rakuten Bank

Rakuten Bank is an online bank operated by Rakuten. Since it is online, it does not require users to visit the office to make a transfer.

Since it is a bank, transfers with Rakuten Bank cost relay bank fees and a receiving bank fee. Nevertheless, the service gains a reputation for its relatively low fees among bank remittance services.

Another advantage of using a bank is that it has high credibility as a national credit institution.

Combined with the easy account opening process, Rakuten bank is recommended for those who prioritize credibility.

The transaction also has a speedy bank remittance, usually taking from one to three business days.

Japan Post Bank (Yuucho Direct)

In addition to international money transfer services over the counter, Japan Post also accepts international money transfers through an online banking service known as Yucho Direct.

The biggest attraction of Yucho Direct is that it allows users to complete the trusted procedures of Japan Post from the comfort of their homes.

If you have been using Japan Post's international money transfer service and are already familiar with its system, you may be able to achieve smoother international money transfers by using Yuucho Direct.

In addition to the remittance fee, Yucho Direct incurs more fees than most services, such as currency exchange fees, relay bank fees, and receiving bank fees.

Transactions usually take about four business days to be completed. We recommend that you complete the procedure one week in advance to ensure the remittance is on time.

SBI Remit

SBI Remit is an international money transfer service that supports transactions in over 200 countries.

Due to the availability of many destinations, this service is popularly used by many international students and business people who travel around the world.

Since it is an international money transfer service, there are no relay bank fees or receiving bank fees.

However, this service uses its own exchange rate, which means users have to pay the fee that occurs there.

The remittance can be completed within 10 minutes at the earliest, and within 2 business days at the latest, allowing a speedy transaction.

Curfex

Curfex is an international money transfer service that allows transactions to 50 countries, with a growing number of users in Japan in recent years.

Characterized by its low remittance fee and speedy service, Curfex is currently running a fee waiver campaign for first transfers, allowing users to complete their first transaction with no fees. The fee after the second time is also low and flat at 1% of the amount transferred.

The exchange rate is the same as the market rate, and there are no “hidden fees,” so this service is highly regarded as a user-friendly service that does not charge more than necessary.

Another attractive feature of Curfex is that it allows for speedy transactions, with remittance times ranging from the same day to within two business days. As a money transfer company licensed by the Financial Services Agency, users can rest assured that their money will be transferred even in the event of a default on the company’s end.

Although it may not be as well known as other services, Curfex is an international money transfer service that is attracting a lot of attention for its security and low fees.

Summary of Each Service

The table below compares the fees for each of the international money transfer services introduced above. Use it as a reference for choosing a service when sending money to another country.

Recommended International Money Transfer Service by Destination Country

Some services charge a flat fee no matter where the money is sent, while other services charge different fees depending on the destination country.

The remittance time also tends to vary depending on the destination country, so it is important to check the cost in advance.

In this section, we will look into the difference depending on the destination, using several countries as examples.

Money Transfers to Korea

If the remittance destination is Korea, how would the processing time and fees be for each international money transfer service and financial institution?

Visit the link below to find a comparison of not only the international money transfer services listed above but also services commonly used in the country.

https://curfex.ghost.io/international-money-transfer-service-comparison-for-korea-en/

Money Transfers to the U.S.

The article below compares the processing time and fees for international money transfer services in this country, as well as some other commonly used international money transfer methods for sending money to the U.S.

https://curfex.ghost.io/money-transfers-japan-us-basic-knowledge-en/

Money Transfers to China

Visit the article below to check the simulation of the processing time and fees with the international money transfer services listed, as well as some other commonly used international money transfer methods for sending money to China.

https://curfex.ghost.io/transferring-money-family-friends-china-en/

Money Transfers to Germany

Visit the article below to check the simulation of the processing time and fees with the international money transfer services listed, as well as some other commonly used international money transfer methods for sending money to Germany.

Money Transfers to the U.K.

Visit the article below to check the simulation of the processing time and fees with the international money transfer services liste, as well as some other commonly used international money transfer methods for sending money to the U.K.

Prepare for International Money Transfers Before Studying Abroad!

Despite its essentiality, many people tend to put off the preparation of international money transfers when studying abroad.

While many assume that receiving money abroad would be as smooth as domestic money transfers, international money transfers are a complex process that requires prior identity verification and security checks.

It is very important to prepare beforehand because once in the country, it is common to be so busy getting used to the new lifestyle that you do not have time for such procedures.

Among the international money transfer services introduced in this article, Curfex is especially recommended for those who are planning to study abroad.

If you sign up with Curfex now and use the fee-waiver campaign, you can complete your first transfer at no charge. In addition, the transfer is very speedy, allowing you to send and receive money even upon urgent needs.

If you plan to study abroad soon, we highly recommend signing up with Curfex now and being ready for your first-time transfer at no charge!

Click here to sign up

References:

https://www.remit.co.jp/kaigaisoukin/sendremittance/

https://ires.remit.co.jp/IRESWeb/MainCommissionSimulator_Input.jsf

https://www.remit.co.jp/kaigaisoukin/exchangeratecommission/commission/

Member discussion