Why Can't Credit Cards Be Used for International Money Transfers? Introducing Debit Cards as an Alternative

When sending money internationally, the most common options are bank transfers and international money transfer services. While bank transfers can transfer money directly from the sender’s bank account, international money transfer services require them to deposit money into an account opened within the country of service.

There are various deposit means to choose from, but it is important to review what can be used and what cannot be used with international money transfers.

In this article, we will discuss debit and credit cards as deposit means for international money transfers, and explain why they can and cannot be used.

If you consider using an international money transfer service, this article will surely help you!

Credit Cards Cannot be Used for International Money Transfers

Credit cards are usually not available as a deposit method with international money transfers.

Credit cards are a major cashless payment method commonly used around the world. Since commercials often promote them as a convenient payment method for shopping abroad, many people tend to think that they can be used for all types of international transactions, including money transfers.

However, this is not the case with international money transfers.

In fact, most international money transfer services do not allow credit card payments. If you intend to make an international money transfer in the future, this is something that should be kept in mind.

Why are Credit Cards not Accepted?

The reason why credit cards cannot be used for international money transfers is that most credit card companies do not accept international transfer transactions.

Credit cards function in such a way that when it is used, it borrows money in advance from a financial institution, and the user pays the amount used during the current month in the following month.

This is a risk for financial institutions, which is why they screen the user’s annual income and occupation upon issuance and set a limit to the maximum amount.

Companies accept general purchases and issue a card once the screening is complete.

On the other hand, international money transfers involves some unique factors, such as exchange rates, which create the risk of unexpected charge for credit card companies, and are therefore not accepted.

Some companies support international money transfers as long as it is between companies.

Since they are considered to have a credibility to a certain level, transactions between companies are seen less likely to cause risk. On top of that, the transaction amount also tend to be large, making it profitable for credit card companies.

Meanwhile, with money transfers between individuals, companies have to expect the users to be creditworthy to allow the transaction. Those with a history of overdue or unpaid payments, or debt, are seen to hold a significant risk.

Companies and other legal entities have high social credibility and are easier to approve their use for international money transfers.

You may find information online that credit card payment is accepted for international money transfers, but in most cases, it only applies to transactions between businesses. If you wish to use a specific credit card company, we recommend checking the policy in detail.

Debit Cards Can be Used for International Money Transfers

Although credit cards cannot be used for deposits for international money transfers, debit cards are often accepted as a deposit method.

This is due to their system, which is very different from that of credit cards.

The most significant difference between a credit card and a debit card is the timing of payments.

With a debit card, the amount spent is immediately debited from your account, rather than borrowing the same amount as with a credit card. When you make a debit card, you are required to set up a bank account, which will be linked to your payments. Once you make a purchase, the amount spent is debited from the linked account. In other words, you can only use the amount that was already in the bank account.

This system does not require the card company to pay the user’s spent amount in advance; the money is automatically debited from their own registered bank account, leaving no risk for the card company. This is the primary reason why credit cards are subject to credit checks and debit cards are not.

Thus, unlike credit cards, debit cards can be used as a means of deposit when using international money transfers, because there is no risk for the card company.

Advantages of Using a Debit Card for International Money Transfers

In this section, we will introduce some advantages of using a debit card for international money transfers.

Faster Processing than Bank Transfers

The first advantage is that the procedure tends to be faster compared to bank transfers.

Bank transfers have long been the primary method for international money transfers, and therefore hold great credibility. However, they are not suitable for urgent transactions, as they tend to take a long time to complete, with the average duration being about a week.

Debit cards, on the other hand, offer a quick deposit procedure, and combined with an international money transfer service, which can often complete the procedure within 3 business days, allows users a speedy transaction.

You would have enough time to go through the procedure if the remittance was planned in advance, but in the case of an urgent request from family or friends living abroad, you may need to respond quickly. A debit card is a very convenient means of achieving a speedy procedure.

Saves on Fees Compared to Bank Transfers

The second advantage is that you can save on fees that would incur with bank transfers.

In addition to remittance and exchange fees, transfers through banks require "receiving bank fees," which incur at the receiving bank, and "relay bank fees" charged by the relay banks involved in the procedure.

The number of relay banks involved is often unknown until the transfer is made, and therefore can cause fees to end up being higher than originally expected.

If you use an international money transfer service with a debit card, you will not have to pay these fees and can complete the transfer with as little cost as possible.

Debit Card Points

The third advantage is that you can earn points on your debit card.

In many cases, international remittances involve sending a certain large amount of money. If you use a debit card in such cases, you can take advantage of this and earn points.

Many financial institutions are offering very high point redemption rates these days, so if you are going to send money abroad anyway, it would be wise to use a debit card and earn points.

Disadvantages of Using a Debit Card for International Money Transfers

Now that we have looked at the advantages, let’s discuss some of the disadvantages of using a debit card for international money transfers.

The Application Process

The first point to keep in mind is that if you do not already own a debit card, you will have to go through the application process.

Despite their advantages, debit cards may not be as common as credit cards. If you plan to use one for international money transfers, you will first have to choose a card company and go through the registration process.

Unlike credit cards, the issuance process is usually simple and quick as it does not involve screening. In addition, there is no cost for issuing a card itself, so it may be helpful to complete the registration in advance if you are interested.

Limit to the Transaction Amount

The second disadvantage is that you can only transfer money up to the limit amount set by the card.

This is important to keep in mind when using not only debit cards but any card that has a monthly limit. If you need to transfer a large amount of money at a time and the amount exceeds the limit, you will not be able to complete the procedure with one transaction.

This may seem like an inconvenience, but having a limit can also prevent overspending beyond what is necessary.

When you use a cashless payment system like a card, you may overspend without realizing it and end up with no amount left in your account. This is not entirely negative, as it also prevents irretrievable mistakes, so be sure to make good use of it when using it for international money transfers.

Recommended International Money Transfer Services That Accept Debit Cards

So, what would be the best international money transfer service to use with a debit card?

In this section, we will introduce three popular services with an overview and points to keep in mind.

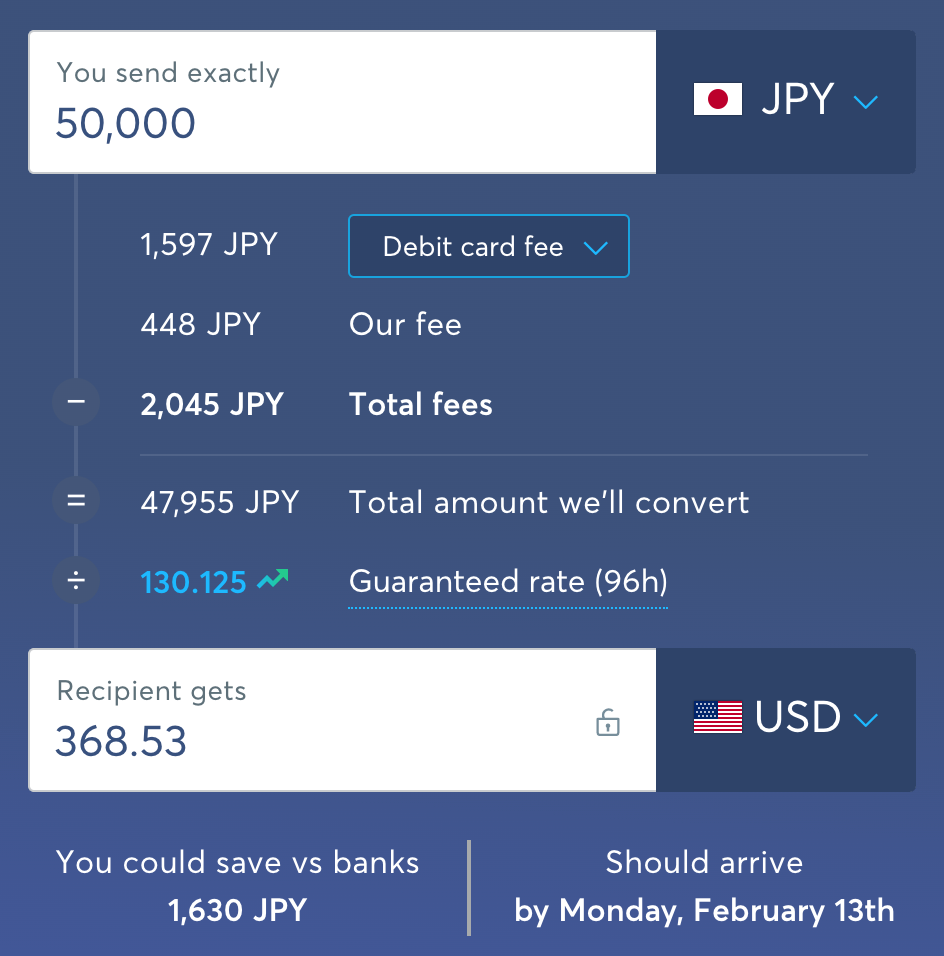

Best Value International Money Transfer Service #1: Wise

The first international money transfer service is Wise.

Wise is an international money transfer service based in the United Kingdom that supports transfers to 80 countries. Although it applies a fixed fee for each currency, there are no relay bank fees as with bank transfers, making it a relatively affordable option.

Transactions are usually completed within the same day or two business days, so if you have an urgent money transfer, this would be a desirable option.

Wise allows international money transfers between individuals using debit cards.

There is no fee for a deposit with a debit card as long as the payment is made in the currency in your account. However, If you don’t have the currency in your account there’s a conversion fee as shown in the picture below.

If you make a payment in a currency that is not in your account, the currency with the lowest exchange fee will be used to exchange the money, and a fee will be charged.

Best Value International Money Transfer Service #2: PayPal

The second international money transfer service is PayPal.

PayPal is popular worldwide as an electronic payment service that can be used for everyday purchases. It also supports international money transfers, which is a great advantage to users as they can use the same account that they use on a daily basis.

However, while PayPal currently supports business-to-business transactions, it does not allow individuals to make international money transfer transactions with a debit card.

Many users may assume that debit card transactions are possible due to its popularity, but we recommend researching the deposit method in advance if you plan to use PayPal.

Best Value International Money Transfer Service #3: Curfex

The third international money transfer service is Curfex.

Curfex is a newer international money transfer service compared to others, but it attracts attention as a highly secure service that has been approved by the Financial Services Agency.

One of the greatest features of Curfex is the unmatched low fees. The fee system is very simple and clear, with no remittance fee for the first transaction (1% of the remittance amount is charged for the second and subsequent transactions), and it adopts the mid-market rate, which means there are no ‘hidden’ fees.

The transactions are handled at a high speed, usually completed within the same day or two business days, allowing a smooth international money transfer.

Curfex accepts debit cards for international money transfers between individuals. By registering your debit card, you can deposit funds to your Curfex account very easily.

A fee of 1%-5% is charged for using a card at the time of deposit, but the fee details are clearly stated in the estimate, assuring information transparency and no unnecessary charges.

Use Curfex to Send Money Internationally with a Debit Card at a Low Fee

In this article, we introduced the procedures for international money transfers using a debit card.

Debit cards have services that can be used for international money transfers between individuals. If you are interested in using your card to make payments, why not give it a try?

Curfex is a highly recommended service for international money transfers.

In addition to the significantly low fees and high speed, it allows debit card deposits for transfers between individuals.

Not only are the fees low, but the amount is clearly stated in advance in an estimate, so there is no need to worry about problems such as fees being higher than expected.

Currently, Curfex is offering a fee waiver campaign for the first transfer.

If you plan to send money internationally in the future, we recommend that you first sign up for Curfex and be prepared to complete the transfer at a low fee!

References:

https://www.paypal.com/jp/smarthelp/article/%E3%83%9A%E3%82%A4%E3%83%91%E3%83%AB%E3%81%AE%E3%82%A2%E3%82%AB%E3%82%A6%E3%83%B3%E3%83%88%E3%81%AB%E7%99%BB%E9%8C%B2%E3%81%A7%E3%81%8D%E3%82%8B%E3%82%AB%E3%83%BC%E3%83%89%E3%81%AF%E4%BD%95%E3%81%A7%E3%81%99%E3%81%8B%E3%80%82-faq1119

https://www.remit.co.jp/kaigaisoukin/sendremittance/method/internet/#:~:text=1%20%E6%BA%96%E5%82%99%E9%87%91%E5%8F%A3%E5%BA%A7%E3%81%AB%E5%85%A5%E9%87%91&text=%E5%85%A5%E9%87%91%E3%81%AF%E9%8A%80%E8%A1%8C%E5%96%B6%E6%A5%AD%E6%99%82%E9%96%93,%E6%97%A5%E3%81%AB%E5%8F%8D%E6%98%A0%E3%81%95%E3%82%8C%E3%81%BE%E3%81%99%E3%80%82&text=%E5%85%A8%E5%9B%BD%E3%81%AE%E3%82%86%E3%81%86%E3%81%A1%E3%82%87%E9%8A%80%E8%A1%8CATM,%E3%81%AE%E7%99%BA%E8%A1%8C%E3%81%AF%E7%84%A1%E6%96%99%E3%81%A7%E3%81%99%E3%80%82

https://wise.com/ja/help/articles/2970190/wise%E3%83%86%E3%83%92%E3%83%83%E3%83%88%E3%82%AB%E3%83%BC%E3%83%88%E3%81%AE%E5%88%A9%E7%94%A8%E6%96%B9%E6%B3%95

Member discussion